By conducting this comparison, we aim to show the benefits of using the radicant debit card while paying in foreign currencies, as it is the cheapest option available in Switzerland.

How does a foreign exchange rate work when paying in a foreign currency?

When you pay with your Swiss debit card in another currency than CHF, usually your bank applies a couple of fees:

All banks start with the same foundation, the interbank exchange rate (or mid-market rate), which is the real exchange rate between two currencies.

Then, banks start adding mark-ups and fees that make your payment more expensive than it should be:

- Adding a hidden margin/ mark-up on the exchange rate creates a more expensive exchange rate compared to the real rate. This is done by the card schemes (Visa/ Mastercard rates as used by many digital banks) or directly by traditional banks.

- Adding transaction fees: x % on the amount spent (for ex, 2%) and/ or an additional fixed fee (for example CHF 1.50 per transaction)

- Adding handling/ processing fees.

At radicant, we have decided to apply no fees at all! No mark-up fees, no transaction fees, nothing. We just apply the interbank exchange rate.

The method

This study was conducted on Tuesday the 19th of March 2024 by comparing the foreign exchange rates of debit/credit cards of 6 different banks:

- Revolut VISA Debit (account in CHF)

- Yuh Debit Mastercard (account in CHF)

- Neon Debit Mastercard

- PostFinance Debit Mastercard

- Migros Bank VISA Debit

- CSX Debit Mastercard

We selected these banks for one of these two reasons: banks with high market share in Switzerland or banks claiming to have low foreign exchange fees.

The respective exchange rate was collected through the app of each bank, after making a payment with the respective cards and receiving the fully booked transaction.

Comparison

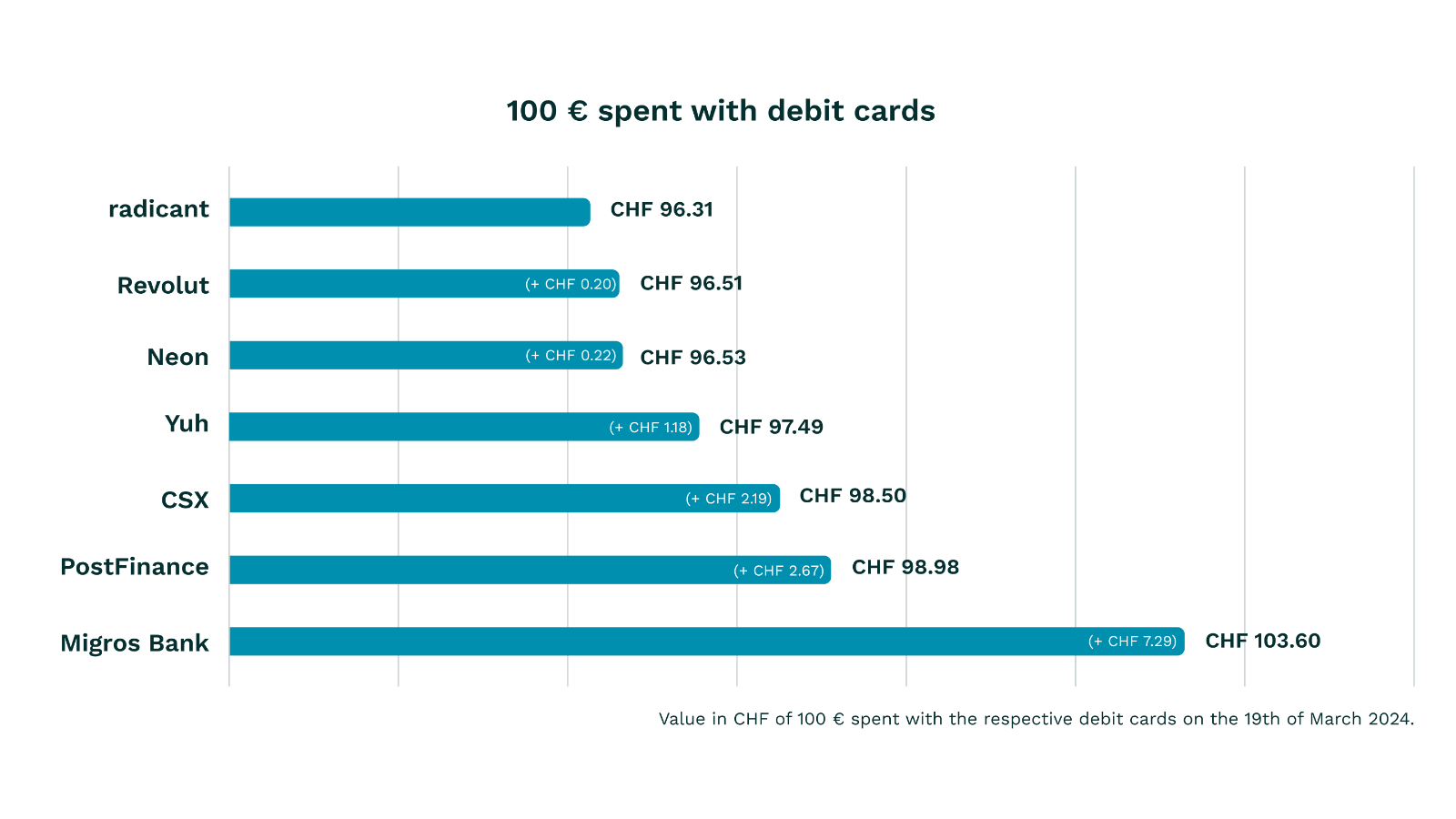

100 € spent with the respective cards on the 19th of March 2024:

Disclaimer

The payments with the different banks were made at different points in time, between 11:00 and 15:00 CET, during which:

- the mid-market rate went from 0.9624 (at 11:00) to 0.9631 (at 13:00) to 0,9640 (at 15:00)1, with a day average of 0.96512.

- radicant rate went from 0.9623 (at 11:00) to 0.9628 (at 13:00) to 0.9637 (at 15:00).

Please note that some banks apply the exchange rate at the moment of the payment while others like radicant apply the rate when the transaction is fully booked (which means 1 to 2 days later).

1 https://www.xe.com/currencycharts/?from=EUR&to=CHF&view=1Y

2 https://www.exchange-rates.org/exchange-rate-history/eur-chf-2024-03-19