The Basics – Economy's Dependence on Nature

Nature consists of various ecosystems. An ecosystem is a community of living creatures in a specific habitat. It can be small like a pond or big like the Amazon basin. Each ecosystem produces so-called ecosystem services such as cleaning the air and water, pollinating plants, providing local recreation areas, flood protection or simply providing resources such as timber, gravel, or food. Our life, our society, and also our economy is built on these ecosystem services. Without primary economic industries, there will be no processing or service-oriented companies.

"Over half (55%) of global GDP, equal to USD 41.7 trillion, is dependent on high-functioning biodiversity and ecosystem services"

The many different creatures in ecosystems, the diversity of ecosystems, and the genetic diversity in general form biodiversity. Living organisms provide most of the ecosystem services. Accordingly, these services are only made possible by biodiversity. At the same time, biodiversity is also responsible for the resilience of ecosystems. Similar to an investment portfolio (and other complex systems), diversity allows and absorbs small shocks and prevents large ones, that would shake the system.

Economy meets nature–and very hard

The economy depends on healthy ecosystems and biodiversity, but it is also a major driver for their destruction. Wood and paper, agriculture, chemicals, fisheries, tobacco, textiles, coal, oil and gas, transportation and mobility, as well as resource extraction are generally the industries with the greatest direct negative impact on nature.

Paradoxically, many of these industries are also most dependent on nature and therefore the most affected by its losses. The five main drivers of ecosystem and biodiversity loss are:

- Land use,

- Commercial use, exploitation, and poaching,

- Climate crisis

- Pollution

and invasive species

Together they lead to an unprecedented loss of biodiversity and ecosystems, which will strongly affect us humans, too.

Image 1: PBES (2019) - beyond business as usual: biodiversity targets and finance

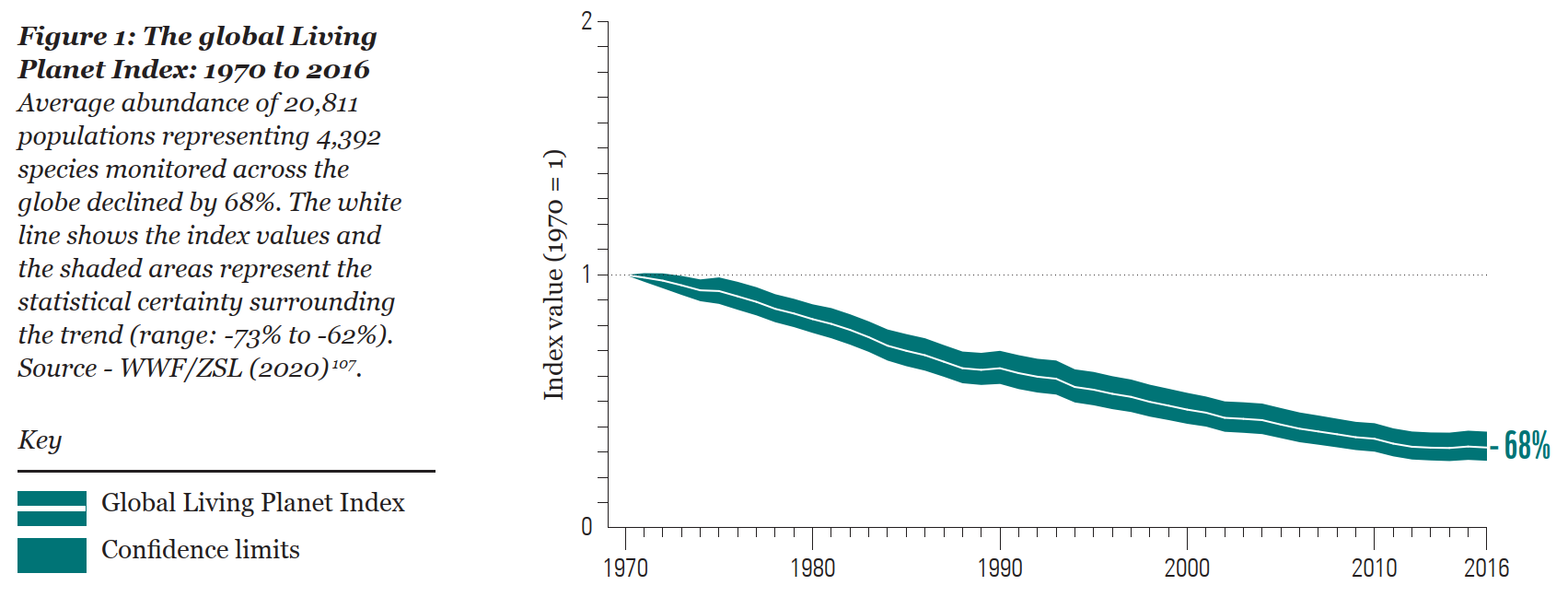

Image 2: WWF Living Planet Report 2020

Invest in nature, not against it

How and why should we apply these insights when investing in the public market? The ‘why’ is easy to answer: if we do not want to destroy our livelihood and economic foundations, we should take a close look when investing: which companies have negative or positive effects on ecosystems and biodiversity.

When it comes to ‘how’, there are basically two key considerations: a) to minimize the damage (the so-called ecological footprint) or b) to maximize the solutions (handprint). In short, this means that we do not want to invest in companies that fundamentally harm ecosystems and biodiversity. On the one hand, we can specify this via exclusion criteria. For example, we can categorically exclude companies that mainly produce non-certified palm oil. On the other hand, we look in detail at which companies have a negative impact on nature with their products and operations. It is important not only to look at the operational aspects such as water consumption or the amount of waste during production. We also want to focus on a company's products and services. On the one hand, these themselves can have significant and often major negative effects in their use - think, for example, of the product "pesticides" of a chemical company. On the other hand, the products and services are often decisive for the operation and the upstream supply chain. For example, if a company produces fast fashion (i.e. very cheap clothes), then pollution of water bodies by chemicals used in the dyeing process is virtually inevitable in the countries of manufacture.

In addition to minimizing the ecological footprint, we also want to invest in companies that offer solutions to ecosystem and biodiversity losses. Here, we focus entirely on the products and services of a company. We identify companies that, for example, produce and distribute sustainable agricultural products, operate recycling or certified forest management, treat wastewater, or restore soils and stretches of sea.

So, money does grow on trees after all

All in all, it is not wrong to say that money grows on trees (representing all of nature). A functioning economy is based on an intact nature. Together, we must find a solution so that economy and nature work in symbiosis, and nature regenerates itself instead of being exploited. We will therefore make targeted investments in companies that minimize their ecological footprint and, above all, have a positive handprint on nature. Hence, we are looking for companies that balance their very big hands on very small feet.

Co-Author: Philipp Staudacher